PREREQUISITES FOR HOMEOWNER ELIGIBILITY

The following must be completed prior to submitting a Homeowner Application:

- Be 18 years of age or older and be able to provide proof of U.S. citizenship or legal residency.

- Pay a $25 non-refundable Pre-Screening Application fee (money orders or cash only)

- Complete and submit a Pre-Screening Application

RESTRICTIONS –

- Applicants cannot currently own a home/have owned a home within the past 12 months.

- Applicants must be citizens of Hardin County and have lived in the county.

- Applicants must not have declared bankruptcy within the past 18 months.

NEXT STEPS

Once your Pre-Application and credit report are approved, you will continue to the application process. You must meet Habitat’s three basic guidelines (Need, Ability to Pay, and Willingness to Partner) to be eligible to purchase a home from Hardin County Habitat for Humanity.

Need

The housing you live in is at least one of the following:

- Overcrowded

- Poorly maintained (substandard)

- In a dangerous neighborhood

- You are currently living with family or friends (homeless)

– AND –

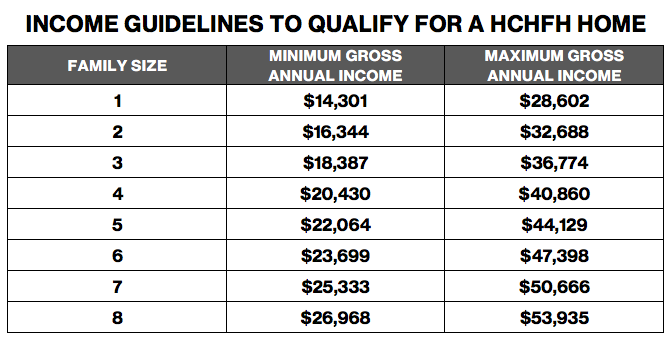

- Your income falls within the following guidelines:

Ability to Pay

- You owe less than $3,000 in total debt (or you owe less than $5,000 in total debt and a majority of it is for a car loan, student loans, or medical bills and you have a clean credit history).

- You have not declared bankruptcy in the last 18 months.

- You pay your rent on time.

- You have had stable income for the past 12 months.

- Your income falls within the Income Guidelines above.

Willingness to Partner

- You are willing to partner with Habitat and put in 500 hours of “Sweat Equity” (or 250 hours if you are single) by first working on other families’ homes, then building your own home.

- You are willing to attend financial literacy classes.

You’ve been approved for a home! What now?

You must:

- Work 500 hours of “Sweat Equity” (or 250 hours if you are single) – first help build other families’ homes, then help build your own home.

- Attend financial literacy classes.

- Pay closing costs of $1,200 prior to mortgage closing.

- Your debt MUST NOT INCREASE while in the program.

- Pay a monthly mortgage, on time, for approximately 25 years.

For more information, please visit our FAQ page.